mobile county al sales tax form

Some cities and local governments in Mobile County collect additional. Mobile County AL Sales Tax Rate The current total local sales tax rate in Mobile County AL is 5500.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

You are also required.

. Mobile County License Commission. Mobile AL 36652-3065 Office. Box 1848 decatur alabama 35602 phone.

1 County Tax 12 School Tax total 15 Should you have any questions. In Mobile or our Downtown Mobile office at 151 Government St. Revenue Office Government Plaza 2nd Floor Window Hours.

Please print out the forms complete and mail them to. General SalesUse tax will calculate at the rate of 15 which includes the 1 Mobile County SalesUse Tax and the ½ Mobile County School SalesUse Tax. In Mobile Downtown office is.

The December 2020 total local sales tax rate was also 5500. A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. 800 to 300 Monday Tuesday Thursday and Fridays and.

SALES USE TAX MONTHLYTAX RETURN CITYOF MOBILE POBOX 2745 MOBILEAL36652-2745 PHONE 251 208-7461 FIGURES MAY BE ROUNDED TO NEAREST DOLLAR Is this a. Tax measure should be fully. You will be responsible to pay the buyer the initial delinquent tax and cost plus any additional property tax the buyer has paid during the three year redemption period.

Box 1169 Mobile AL 36633-1169. The tax is collected by the seller. Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd.

The December 2020 total local sales tax rate was also 10000. Mobile County License Commission. Mobile County Al Sales Tax Form.

251 574 - 8551. All retail types of sales. Sales Tax Form 12.

Ad Avalara Returns for Small Business Can Automate the Sales Tax Filing Process. Sales tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama by businesses located in Alabama. Ad Avalara Returns for Small Business Can Automate the Sales Tax Filing Process.

Sales Tax Form 12. Mobile County License Commission Main Office 3925-F Michael Boulevard Mobile AL 36609. Try it Today with Our 60-Day Free Trial.

Mobile County License Commission Main Office 3925-F Michael Boulevard Mobile AL 36609. Food Beverage Tax Form 7. Direct Petition for Refund.

251 574 - 8551. Board of Equalization-Appeals Form. Sales outside the city limits of mobile and prichard are taxed at the following rates.

Mobile AL Sales Tax Rate. Petition for Release of Penalty. The current total local sales tax rate in Mobile AL is 10000.

Leasing Tax Form 3. Leasing Tax Form 3. Joint Petition for Refund.

The mobile county alabama sales tax is 550 consisting of 400 alabama state sales tax and. City of Mobile Alcoholic Beverage Application. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax.

Petition for Release of Penalty. Try it Today with Our 60-Day Free Trial.

Easytag Automobile Registration Made Simple

Sales Tax Form 12 City Of Mobile Cityofmobile Fill And Sign Printable Template Online Us Legal Forms

Filing An Alabama State Tax Return Things To Know Credit Karma

Lee County Tax Collector Official Site

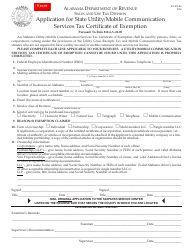

Form St Ex A3 Download Fillable Pdf Or Fill Online Application For State Utility Mobile Communication Services Tax Certificate Of Exemption Alabama Templateroller

Mobile County Health Department A Legacy Of Excellence Since 1816

Locations Mobile County Revenue Commission

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Locations Mobile County Revenue Commission

Fillable Online Revenue Alabama Application For Sales And Use Tax Certificate Of Exemption Revenue Alabama Fax Email Print Pdffiller

Sales Tax Mobile County License Commission

Alabama Income Tax Calculator Smartasset

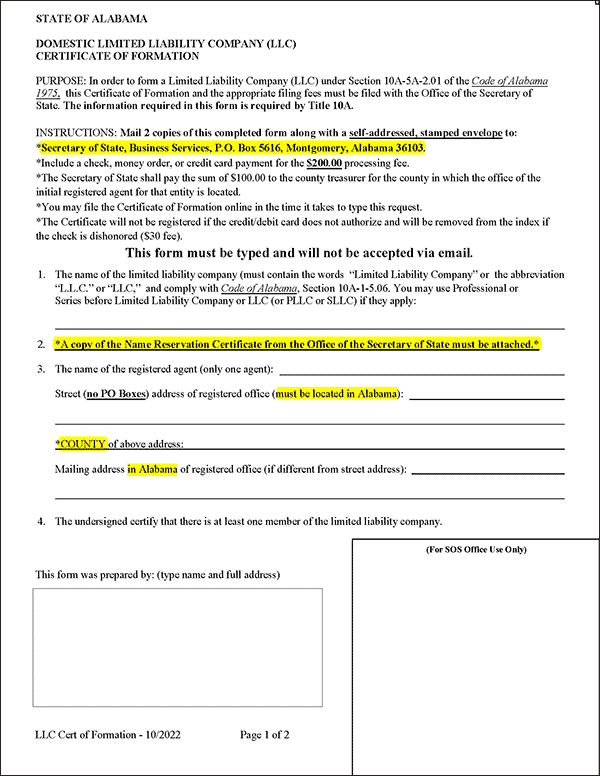

Llc In Alabama How To Start An Llc In Alabama Truic

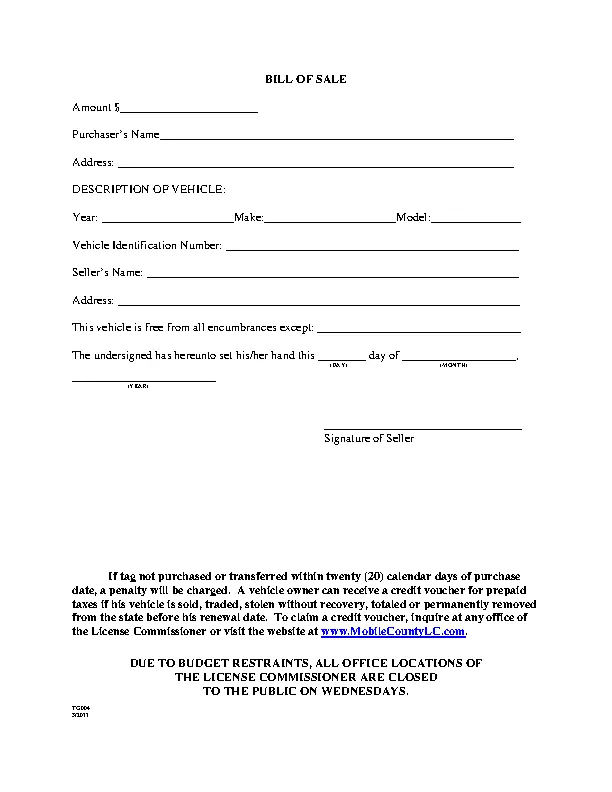

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates